ETFs is something to definitely consider if you're looking for stocks, but you're not sure what to invest in.

An ETF (exchange traded fund) is when an investment company or investment bank creates a fund which people can buy in a manner similar to buying a stock, and then that company/bank uses the money from the fund to invest in other companies which they think will go up in value (and/or provide dividends).

The company or bank managing the ETF takes on the responsibility of managing the money/trading stocks of a variety of companies for you, and you don't have to worry about doing it yourself.

However not all ETFs actually have that nice "Darling Curve" that I am looking for.

Take XIU (from BlackRock) for example. You can see that big dip from March 2020 when the pandemic happened and how it hurt a lot of the stocks that the ETF was invested in. This wasn't that unusual however. A lot of stocks took a nose dive in March 2020, and as you can see many of them also recovered.

XIU has seen soared to record highs, which tells me that this is an ETF that is recession resistant and recovers quickly.

Did it take a few months to pull off a full recovery? Yes, it did. But did it pull it off? Yep. Yep, it did.

What I also like about ETFs is that they're stable. They're basically guaranteed to go up in value. Eventually. Not always right away. You just have to be patient, which makes them a good candidate for long term investments.

The other thing I like is that they invest in companies that I might not otherwise consider investing in (or can afford to invest in). Thus it allows me to diversify my portfolio more, with less research required on my part, while still hedging my bets.

Overall, a smart investment.

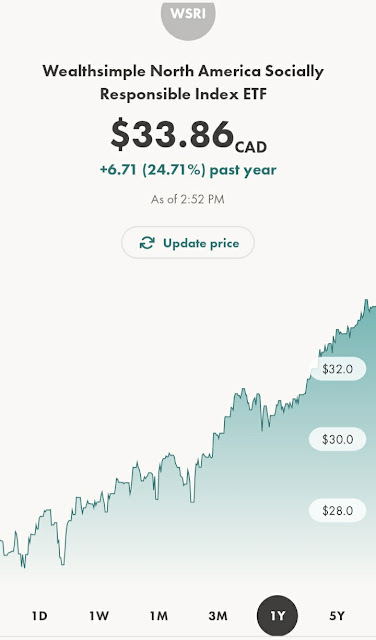

The next one I want to talk about is WSRI (Weathsimple's North America Socially Responsible Index ETF).

WSRI is a relatively new ETF. It has only been around for a little more than a year, hence why the chart shown on the right is set to 1Y (one year).

But during that one year you can see the ETF went up in value by almost 25%, and that it is very consistent about going up in value.

That is a very sexy Darling Curve in my opinion.

So if you want to hedge your bets by investing in ETFs I recommend starting with these two ETFs.

Any other ETFs you come across you should definitely research, but when researching these two I think you will find them to be very smart choices.

Definitely worth researching AND investing in.

HAPPY INVESTING!

No comments:

Post a Comment

ALL COMMENTS ARE MODERATED. SPAM COMMENTS WILL BE DELETED. ANYTHING CONTAINING A LINK WILL BE CONSIDERED TO BE SPAM.