BLU is one of my best performing stocks currently, but I have decided to do something unusual.

I am going to sell 46% of my BLU stock when it hits $8.25 CDN per share.

I bought the stocks months ago for $3.49 per share, so if I sell roughly half of my shares I will get back my initial investment in the stock (plus a tidy profit) and my remaining shares of the stock I can then just "let it ride".

Imagine for example you had purchased 1000 shares for $3.50 each ($3500 worth) and you wait until it is worth $8.25 per share, at which point you sell 500 shares for $4,125...

So you just made a profit of $625, got back your initial $3500, plus you get to keep the other 500 shares, to see if the shares continue to go up in value.

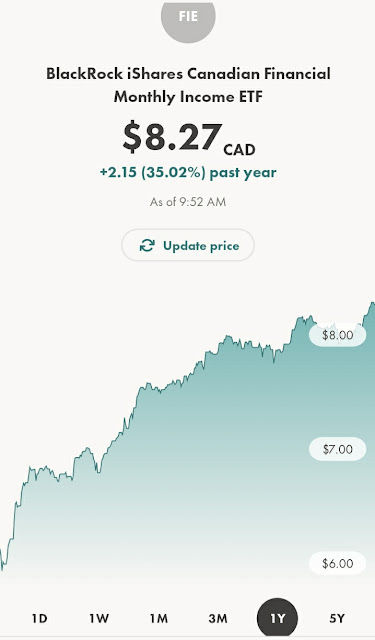

My issue, part of the reason I am doing this, is because I have a sizable chunk of my portfolio in BLU (a bit too much really) and I would rather take my profits from that and put that money into some ETFs so I am diversifying my portfolio more.

...

And my stocks just sold. In less time than I needed to write this blog post my stocks of BLU sold for the price I was asking for, using a Limit Sell of $8.25. And the value of the stock price just got pushed up. It started the day at less than $8.

What is a Limit Sell?

A limit sell is when you set a minimum price you are willing to sell the stocks for.

Earlier today the stock was hovering around $8 even, but I wanted to sell for $8.25 or more so that I am guaranteed to make a profit off my sale. (Buying/Selling at Market Rate is for suckers.)

So I set up the Limit Sell and put a 90 day extension on the sale, so that even if it doesn't sell today (which it did), it could still sell tomorrow or any time within the next 90 days for my asking price.

The beauty of doing a Limit Sell is that there are suckers out there who are buying at average Market Rate who will pay your asking price (either as a Market Buy or a Limit Buy), even if it is more than what they are bidding, so long as the Average Price of their purchase averages out to a number matching their Limit Buy (etc).

Thus if your Limit Sell is within a certain range (5% more than asking price or less) of what people are bidding, you can usually sell your stock for a higher amount than what it is actually worth because there will be other people selling their stock for less (5% under the normal price), but the value of your stocks will be bundled together and sold to the buyer.

Like I said above... Buying/Selling at Market Rate is for suckers.

If you're good at math you can easily just buy/sell everything for between a margin of 3 to 5%.

Thus if you want to buy $1000 worth of stock, but you make a Limit Buy for 3% less than the value of the stock chances are likely you will still make your purchase because your purchase will be bundled together with other people looking to buy versus other people looking to sell (at market rate or a limit sell).

And later when it is time to sell for a profit, you do the same thing, but in reverse - asking for a higher price that is 3% to 5% above market rate.

Thus you can potentially make a 6% to 10% profit off a stock, trusting that it is popular and volatile enough to make up the difference.

What is the downside to Limit Buying/Selling?

Sometimes your purchase or sale doesn't get done. Nobody matches the price you are asking, even when bundled together and averaged. This is why I like the 90 day extension when doing such buys and sales. Someone might not buy/sell it within the 7.5 hour long trading day at the TSX, so it is better to wait and see if it buys/sells the next day/etc for your asking price.

So the downside essentially is that you're either not making the trade at all, or you have to wait longer than expected.

In which case you can always cancel the trade before it happens within the 90 day period if you change your mind. Then you've lost nothing but time spent waiting.

Myself, I would rather be patient and gain an extra 6 to 10% on my investment just by being patient.

So what about BLU?

I am going to sit on the stock now. Let it ride. I have already made a profit on it. I want to see what happens next to the stock. Maybe years or decades from now I will sell it. Or maybe the company will be taken over by a bigger corporation. Should be interesting to watch and see what kind of profit I can get out of it now that I have already made back my initial investment.