Recently I received a notification on WealthSimple regarding the takeover of theScore (a Canadian company also known as Score Media and Gaming Inc.) by Penn National (an American company)...

What followed was that I received stocks in Penn National... and cash.

Now I have to decide several things, chief of which is:

Is it worth keeping my new stocks in Penn National (PENN), or should I sell them?

When I first bought theScore stock (SCR.TO) it was a smart buy. The company is essentially an online casino that uses an app that allows users to gamble on sports. So very low overhead, but high profits thanks to the app being the #1 sports gambling app in Canada (and #3 in North America).

It was a smart move for me to buy the stocks... and it is similarly a smart deal for Penn National (which runs hotels, casinos, slot machines, online gambling, horse races, etc.

And we're not talking a small amount either. The takeover of theScore went to the tune of $2 billion USD. So that isn't chump change.

Now you might think: "Wait, isn't there a pandemic going on? Isn't a company that owns hotels inherently risky?"

Yes, in a country that cares about the pandemic. But we're talking about American hotels, a country with a reasonably high vaccination rate and a laissez-faire approach to handling the pandemic. America is open for business. Come hell or high water, they want to make money.

So should I feel guilty about owning hotels in the USA where people will go out, socialize and a percentage of them will die from COVID because they aren't vaccinated?

Nope.

Absolutely not. They made their choice not to get vaccinated. If they die, they die. Not my fault. They live in a pro-choice country (except for Texas).

So the fundamentals of owning stocks in a company which owns hotels/casinos/gambling is pretty solid. Pandemic? Pff! It is full steam ahead in the USA.

So I might as well keep the American stocks in PENN for now. They have a nice upward curve, so they do fit into my definition of a Darling Stock.

What about my rule about preferring to own Canadian stocks?

It is true, I do prefer to own Canadian stocks.

But I also own Canadian companies (and ETFs) which operate internationally. And I own ETFs that invest in American stocks, but are hedged in Canadian dollars. This allows me to invest in American companies, but limits my risk since I prefer to use ETFs that are hedged.

So it doesn't matter.

What about the cash I received after the takeover?

I received half the value of my SCR.TO stocks as cash. So far I have decided to use a portion of that cash to invest in:

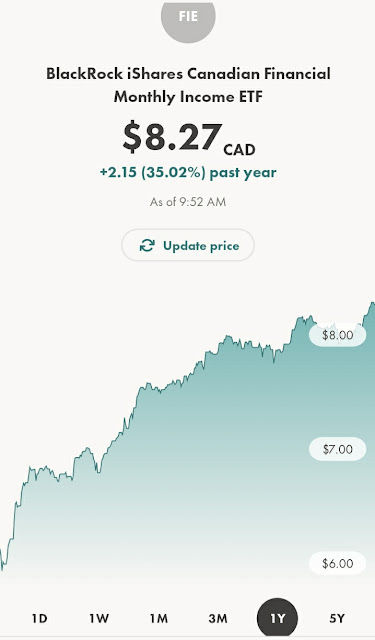

FIE.TO (iShares Canadian Financial Monthly Income ETF)

Now it should be noted that this ETF is currently growing very nicely due to the pandemic, but historically tends to have a flatter curve. What I like about FIE is that it has a yield of 5.79% and it is a historically very stable ETF. So it is a smart buy as a dividend ETF.

I expect it to trend upwards for the next year and then level off, and continue to provide nice fat dividends.

I haven't decided what to do with the rest of the cash I received from the takeover of theScore, but I will sprinkle it around in different things.

No comments:

Post a Comment

ALL COMMENTS ARE MODERATED. SPAM COMMENTS WILL BE DELETED. ANYTHING CONTAINING A LINK WILL BE CONSIDERED TO BE SPAM.